Understanding your health care costs in retirement

Discover the true cost of Medicare for those age 65 and up.

As you plan for retirement, it’s important to consider your health care costs. Medicare is an essential part of health care coverage for those age 65 and over, but understanding the costs can be a challenge.

For example, if we asked you what the average health care costs for a Medicare beneficiary (age 65 and up) were per year, what would you say?

… It’s a tough one, isn’t it?

What if we give you a choice?

A) $0

B) $8,000

C) $22,000

D) $100,000

If you said, C — congratulations! You’re right. (Officially, it’s $21,930.)

But for many, the answer isn’t so simple.

The people have spoken!

We recently ran a Medicare Basics quiz to find out what people know about Medicare, and how we can help them be more prepared when the time comes for them to choose a Medicare plan.

Eighty percent of the nearly 5,000 people who responded answered incorrectly. And while we don’t have a crystal ball to know what your health care costs will be, let’s see how the numbers overall shake out for all Medicare beneficiaries …

From doctor’s visits to home health care

The $21,930 figure comes from the most up-to-date version available of the “Older Americans 2024: Key Indicators of Well-Being” report, published by the Federal Interagency Forum on Aging-Related Statistics. It details the trends in wellness for older Americans.

The average health care costs of $21,930 in 2021 includes both out-of-pocket expenses and costs covered by insurance. However, it bears noting that this also highlights the importance of having the right plan in place to help cover these costs. More on that later …

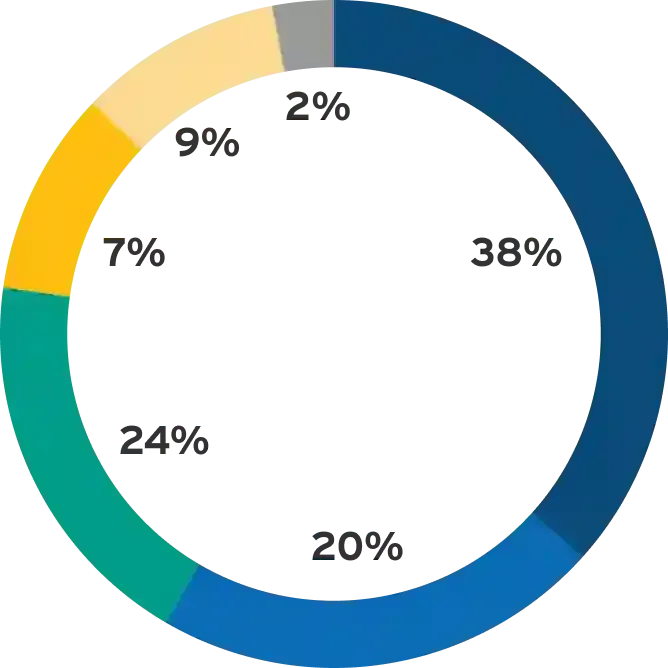

Here’s how the report breaks down these health care costs:

Percent of health care expenses

by good or service 2021

More insights from the report

- Medicare paid for approximately 67% of all health care costs of Medicare beneficiaries age 65 and over in 2021.

- After adjusting for inflation, average annual prescription drug costs for noninstitutionalized Medicare beneficiaries age 65 and over increased between 1992 and 2021 — from $1,235 to $6,432.

- Dental work can be a big out-of-pocket expense: About 78% of dental care was paid out of pocket.

So, what does this mean to you?

If you’re retired and are happy with your health care coverage, we hope this helps you realize the value you’re getting from your coverage.

If you’re thinking about retiring or planning for it, we want you to know you don’t have to go it alone. Here are three easy ways to help you make the right choice.

1) Talk to an agent. A licensed insurance professional who’s well-versed in all things Medicare can help you in no time at all. Be sure to take your time and find one who listens and walks you through all of your options.

2) Head over to the Medicare site. If you prefer to begin researching yourself, visit the Getting Started section of Medicare’s website. (If you don’t have your newest Medicare & You handbook, be sure to download the PDF.)

- 3) Talk to someone at your State Health Insurance Assistance Program (SHIP). If you prefer to have help from a trained counselor, visit shiphelp.org. Local programs go by different names, but the State Health Insurance Assistance Program (SHIP) is a community-based network of counselors throughout the country. SHIP counselors have been screened, trained and certified as Medicare experts.

With this added knowledge, you’ll have a better understanding of the importance of finding the right health care coverage for you in retirement — and what you’re getting with that coverage.